12th April, 2017

The Goods and Services Tax (Compensation to States) Act

An Act to provide for compensation to the States for the loss of revenue arising on account of implementation of the goods and services tax in pursuance of the provisions of the Constitution (One Hundred and First Amendment) Act, 2016.

- BE it enacted by Parliament in the Sixty-eighth Year of the Republic of India as follows:-

-

1. Short title, extent and commencement.

(1) This Act may be called the Goods and Services Tax (Compensation to States) Act, 2017.

(2) It extends to the whole of India.

(3) It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint.2. Definitions.

(1) In this Act, unless the context otherwise requires,—- "central tax" means the central goods and services tax levied and collected under the Central Goods and Services Tax Act;

- "Central Goods and Services Tax Act" means the Central Goods and Services Tax Act, 2017;

- "cess" means the goods and services tax compensation cess levied under section 8;

- "compensation" means an amount, in the form of goods and services tax compensation, as determined under section 7;

- "Council" means the Goods and Services Tax Council constituted under the provisions of article 279A of the Constitution;

- "Fund" means the Goods and Services Tax Compensation Fund referred to in section 10;

- "input tax" in relation to a taxable person, means,––

(i) cess charged on any supply of goods or services or both made to him;

(ii) cess charged on import of goods and includes the cess payable on reverse charge basis; - "Integrated Goods and Services Tax Act" means the Integrated Goods and Services Tax Act, 2017;

- "integrated tax" means the integrated goods and services tax levied and collected under the Integrated Goods and Services Tax Act;

- "prescribed" means prescribed by rules made, on the recommendations of the Council, under this Act;

- "projected growth rate" means the rate of growth projected for the transition period as per section 3;

- "Schedule" means the Schedule appended to this Act;

- "State" means,––

(i) for the purposes of sections 3, 4, 5, 6 and 7 the States as defined under the Central Goods and Services Tax Act; and

(ii) for the purposes of sections 8, 9, 10, 11, 12, 13 and 14 the States as defined under the Central Goods and Services Tax Act and the Union territories as defined under the Union Territories Goods and Services Tax Act; - "State tax" means the State goods and services tax levied and collected under the respective State Goods and Services Tax Act;

- "State Goods and Services Tax Act" means the law to be made by the State Legislature for levy and collection of tax by the concerned State on supply of goods or services or both;

- "taxable supply'' means a supply of goods or services or both which is chargeable to the cess under this Act;

- "transition date" shall mean, in respect of any State, the date on which the State Goods and Services Tax Act of the concerned State comes into force;

- "transition period" means a period of five years from the transition date; and

- "Union Territories Goods and Services Tax Act" means the Union Territories Goods and Services Tax Act, 2017.

(2) The words and expressions used and not defined in this Act but defined in the Central Goods and Services Tax Act and the Integrated Goods and Services Tax Act shall have the meanings respectively assigned to them in those Acts. 3. Projected growth rate.

The projected nominal growth rate of revenue subsumed for a State during the transition period shall be fourteen per cent. per annum.4. Base year

For the purpose of calculating the compensation amount payable in any financial year during the transition period, the financial year ending 31st March, 2016, shall be taken as the base year.5. Base year revenue.

(1) Subject to the provision of sub-sections (2), (3), (4), (5) and (6), the base year revenue for a State shall be the sum of the revenue collected by the State and the local bodies during the base year, on account of the taxes levied by the respective State or Union and net of refunds, with respect to the following taxes, imposed by the respective State or Union, which are subsumed into goods and services tax, namely:––- the value added tax, sales tax, purchase tax, tax collected on works contract, or any other tax levied by the concerned State under the erstwhile entry 54 of List-II (State List) of the Seventh Schedule to the Constitution;

- the central sales tax levied under the Central Sales Tax Act, 1956;

- the entry tax, octroi, local body tax or any other tax levied by the concerned State under the erstwhile entry 52 of List-II (State List) of the Seventh Schedule to the Constitution;

- the taxes on luxuries, including taxes on entertainments, amusements, betting and gambling or any other tax levied by the concerned State under the erstwhile entry 62 of List-II (State List) of the Seventh Schedule to the onstitution;

- the taxes on advertisement or any other tax levied by the concerned State under the erstwhile entry 55 of List-II (State List) of the Seventh Schedule to the Constitution;

- the duties of excise on medicinal and toilet preparations levied by the Union but collected and retained by the concerned State Government under the erstwhile article 268 of the Constitution;

- any cess or surcharge or fee leviable under entry 66 read with entries 52, 54, 55 and 62 of List-II of the Seventh Schedule to the Constitution by the State Government under any Act notified under sub-section (4),

Provided that the revenue collected during the base year in a State, net of refunds, under the following taxes shall not be included in the calculation of the base year revenue for that State, namely:— - any taxes levied under any Act enacted under the erstwhile entry 54 of List-II (State List) of the Seventh Schedule to the Constitution, prior to the coming into force of the provisions of the Constitution (One Hundred and First Amendment) Act, 2016, on the sale or purchase of petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas, aviation turbine fuel and alcoholic liquor for human consumption;

- tax levied under the Central Sales Tax Act, 1956, on the sale or purchase of petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas, aviation turbine fuel and alcoholic liquor for human consumption;

- any cess imposed by the State Government on the sale or purchase of petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas, aviation turbine fuel and alcoholic liquor for human consumption; and

- the entertainment tax levied by the State but collected by local bodies, under any Act enacted under the erstwhile entry 62 of List-II (State List) of the Seventh Schedule to the Constitution, prior to coming into force of the provisions of the Constitution (One Hundred and First Amendment) Act, 2016.

(2) In respect of the State of Jammu and Kashmir, the base year revenue shall include the amount of tax collected on sale of services by the said State Government during the base year.

(3) In respect of the States mentioned in sub-clause (g) of clause (4) of article 279A of the Constitution, the amount of revenue foregone on account of exemptions or remission given by the said State Governments to promote industrial investment in the State, with respect to such specific taxes referred to in sub-section (1), shall be included in the total base year revenue of the State, subject to such conditions as may be prescribed.

(4) The Acts of the Central Government and State Governments under which the specific taxes are being subsumed into the goods and services tax shall be such as may be notified.

(5) The base year revenue shall be calculated as per sub-sections (1), (2), (3) and (4) on the basis of the figures of revenue collected and net of refunds given in that year, as audited by the Comptroller and Auditor-General of India.

(6) In respect of any State, if any part of revenues mentioned in sub-sections (1), (2), (3) and (4) are not credited in the Consolidated Fund of the respective State, the same shall be included in the total base year revenue of the State, subject to such conditions as may be prescribed.6. Projected revenue for any year.

The projected revenue for any year in a State shall be calculated by applying the projected growth rate over the base year revenue of that State.

Illustration.—If the base year revenue for 2015-16 for a concerned State, calculated as per section 5 is one hundred rupees, then the projected revenue for financial year 2018-19 shall be as follows—

Projected Revenue for 2018-19=100 (1+14/100)37. Calculation and release of compensation.

(1) The compensation under this Act shall be payable to any State during the transition period.

(2) The compensation payable to a State shall be provisionally calculated and released at the end of every two months period, and shall be finally calculated for every financial year after the receipt of final revenue figures, as audited by the Comptroller and Auditor-General of India:Provided that in case any excess amount has been released as compensation to a State in any financial year during the transition period, as per the audited figures of revenue collected, the excess amount so released shall be adjusted against the compensation amount payable to such State in the subsequent financial year (3) The total compensation payable for any financial year during the transition period to any State shall be calculated in the following manner, namely:–– - the projected revenue for any financial year during the transition period, which could have accrued to a State in the absence of the goods and services tax, shall be calculated as per section 6;

- the actual revenue collected by a State in any financial year during the

transition period shall be—

(i) the actual revenue from State tax collected by the State, net of refunds given by the said State under Chapters XI and XX of the State Goods and Services Tax Act;

(ii) the integrated goods and services tax apportioned to that State; and

(iii) any collection of taxes on account of the taxes levied by the respective State under the Acts specified in sub-section (4) of section 5, net of refund of such taxes, - the total compensation payable in any financial year shall be the difference between the projected revenue for any financial year and the actual revenue collected by a State referred to in clause (b).

as certified by the Comptroller and Auditor-General of India;(4) The loss of revenue at the end of every two months period in any year for a State during the transition period shall be calculated, at the end of the said period, in the following manner, namely:–– - the projected revenue that could have been earned by the State in absence of the goods and services tax till the end of the relevant two months period of the respective financial year shall be calculated on a pro-rata basis as a percentage of the total projected revenue for any financial year during the transition period, calculated in accordance with section 6.

- the actual revenue collected by a State till the end of relevant two months period in any financial year during the transition period shall be—

(i) the actual revenue from State tax collected by the State, net of refunds given by the State under Chapters XI and XX of the State Goods and Services Tax Act;

(ii) the integrated goods and services tax apportioned to that State, as certified by the Principal Chief Controller of Accounts of the Central Board of Excise and Customs; and

(iii) any collection of taxes levied by the said State, under the Acts specified in sub-section (4) of section 5, net of refund of such taxes; - the provisional compensation payable to any State at the end of the relevant two months period in any financial year shall be the difference between the projected revenue till the end of the relevant period in accordance with clause (a) and the actual revenue collected by a State in the said period as referred to in clause (b), reduced by the provisional compensation paid to a State till the end of the previous two months period in the said financial year during the transition period.

Illustration.— If the projected revenue for any year calculated in accordance with section 6 is one hundred rupees, for calculating the projected revenue that could be earned till the end of the period of ten months for the purpose of this sub-section shall be 100x(5/6)=Rs.83.33;(5) In case of any difference between the final compensation amount payable to a State calculated in accordance with the provisions of sub-section (3) upon receipt of the audited revenue figures from the Comptroller and Auditor-General of India, and the total provisional compensation amount released to a State in the said financial year in accordance with the provisions of sub-section (4), the same shall be adjusted against release of compensation to the State in the subsequent financial year.

(6) Where no compensation is due to be released in any financial year, and in case any excess amount has been released to a State in the previous year, this amount shall be refunded by the State to the Central Government and such amount shall be credited to the Fund in such manner as may be prescribed.8. Levy and collection of cess.

(1) There shall be levied a cess on such intra-State supplies of goods or services or both, as provided for in section 9 of the Central Goods and Services Tax Act, and such interState supplies of goods or services or both as provided for in section 5 of the Integrated Goods and Services Tax Act, and collected in such manner as may be prescribed, on the recommendations of the Council, for the purposes of providing compensation to the States for loss of revenue arising on account of implementation of the goods and services tax with effect from the date from which the provisions of the Central Goods and Services Tax Act is brought into force, for a period of five years or for such period as may be prescribed on the recommendations of the Council:Provided that no such cess shall be leviable on supplies made by a taxable person who has decided to opt for composition levy under section 10 of the Central Goods and Services Tax Act. (2) The cess shall be levied on such supplies of goods and services as are specified in column (2) of the Schedule, on the basis of value, quantity or on such basis at such rate not exceeding the rate set forth in the corresponding entry in column (4) of the Schedule, as the Central Government may, on the recommendations of the Council, by notification in the Official Gazette, specify: Provided that where the cess is chargeable on any supply of goods or services or both with reference to their value, for each such supply the value shall be determined under section 15 of the Central Goods and Services Tax Act for all intra-State and inter-State supplies of goods or services or both: Provided further that the cess on goods imported into India shall be levied and collected in accordance with the provisions of section 3 of the Customs Tariff Act, 1975, at the point when duties of customs are levied on the said goods under section 12 of the Customs Act, 1962, on a value determined under the Customs Tariff Act, 1975. 9. Returns, payments and refunds.

(1) Every taxable person, making a taxable supply of goods or services or both, shall—- pay the amount of cess as payable under this Act in such manner;

- furnish such returns in such forms, along with the returns to be filed under the Central Goods and Services Tax Act; and

- apply for refunds of such cess paid in such form,

(2) For all purposes of furnishing of returns and claiming refunds, except for the form to be filed, the provisions of the Central Goods and Services Tax Act and the rules made thereunder, shall, as far as may be, apply in relation to the levy and collection of the cess leviable under section 8 on all taxable supplies of goods or services or both, as they apply in relation to the levy and collection of central tax on such supplies under the said Act or the rules made thereunder 10. Crediting proceeds of cess to Fund.

(1) The proceeds of the cess leviable under section 8 and such other amounts as may be recommended by the Council, shall be credited to a non-lapsable Fund known as the Goods and Services Tax Compensation Fund, which shall form part of the public account of India and shall be utilised for purposes specified in the said section.

(2) All amounts payable to the States under section 7 shall be paid out of the Fund.

(3) Fifty per cent. of the amount remaining unutilised in the Fund at the end of the transition period shall be transferred to the Consolidated Fund of India as the share of Centre, and the balance fifty per cent. shall be distributed amongst the States in the ratio of their total revenues from the State tax or the Union territory goods and services tax, as the case may be, in the last year of the transition period.

(4) The accounts relating to Fund shall be audited by the Comptroller and AuditorGeneral of India or any person appointed by him at such intervals as may be specified by him and any expenditure in connection with such audit shall be payable by the Central Government to the Comptroller and Auditor-General of India.

(5) The accounts of the Fund, as certified by the Comptroller and Auditor-General of India or any other person appointed by him in this behalf together with the audit report thereon shall be laid before each House of Parliament.11. Other provisions relating to cess.

(1) The provisions of the Central Goods and Services Tax Act, and the rules made thereunder, including those relating to assessment, input tax credit, non-levy, short-levy, interest, appeals, offences and penalties, shall, as far as may be, mutatis mutandis, apply, in relation to the levy and collection of the cess leviable under section 8 on the intra-State supply of goods and services, as they apply in relation to the levy and collection of central tax on such intra-State supplies under the said Act or the rules made thereunder.

(2) The provisions of the Integrated Goods and Services Tax Act, and the rules made thereunder, including those relating to assessment, input tax credit, non-levy, short-levy, interest, appeals, offences and penalties, shall, mutatis mutandis, apply in relation to the levy and collection of the cess leviable under section 8 on the inter-State supply of goods and services, as they apply in relation to the levy and collection of integrated tax on such inter-State supplies under the said Act or the rules made thereunder:Provided that the input tax credit in respect of cess on supply of goods and services leviable under section 8, shall be utilised only towards payment of said cess on supply of goods and services leviable under the said section. 12. Power to make rules.

(1) The Central Government shall, on the recommendations of the Council, by notification in the Official Gazette, make rules for carrying out the provisions of this Act.

(2) In particular, and without prejudice to the generality of the foregoing power, such rules may provide for all or any of the following matters, namely:—- the conditions which were included in the total base year revenue of the States, referred to in sub-clause (g) of clause (4) of article 279A of the Constitution, under sub-section (3) of section 5;

- the conditions subject to which any part of revenues not credited in the Consolidated Fund of the respective State shall be included in the total base year revenue of the State, under sub-section (6) of section 5;

- the manner of refund of compensation by the States to the Central Government under sub-section (6) of section 7;

- the manner of levy and collection of cess and the period of its imposition under sub-section (1) of section 8;

- the manner and forms for payment of cess, furnishing of returns and refund of cess under sub-section (1) of section 9; and

- any other matter which is to be, or may be, prescribed, or in respect of which provision is to be made, by rules.

13. Laying of rules before Parliament.

Every rule made under this Act by the Central Government shall be laid, as soon as may be after it is made, before each House of Parliament, while it is in session, for a total period of thirty days which may be comprised in one session or in two or more successive sessions, and if, before the expiry of the session immediately following the session or the successive sessions aforesaid, both Houses agree in making any modification in the rule or both Houses agree that the rule should not be made, the rule shall thereafter have effect only in such modified form or be of no effect, as the case may be; so, however, that any such modification or annulment shall be without prejudice to the validity of anything previously done under that rule.14. Power to remove difficulties.

(1) If any difficulty arises in giving effect to the provisions of this Act, the Central Government may, on the recommendations of the Council, by order published in the Official Gazette, make such provisions, not inconsistent with the provisions of this Act, as appear to it to be necessary or expedient for removing the difficulty:Provided that no order shall be made under this section after the expiry of three years from the commencement of this Act. (2) Every order made under this section shall, as soon as may be after it is made, be laid before each House of Parliament.

-

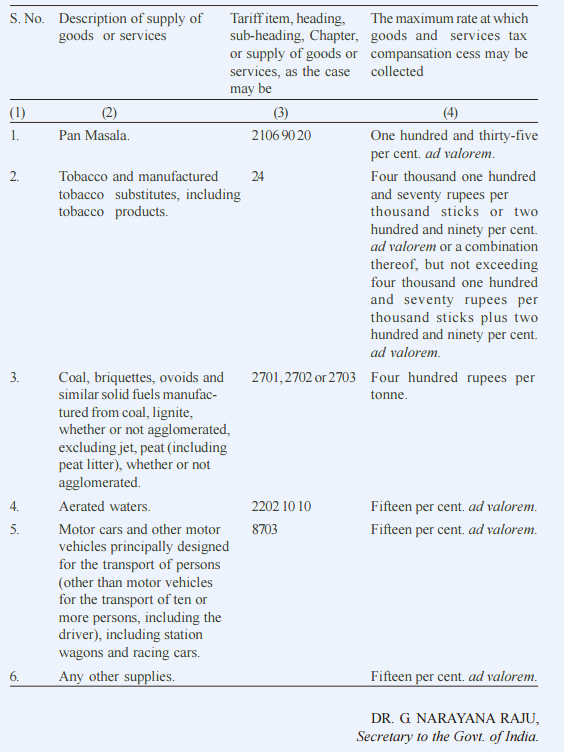

- THE SCHEDULE - [See section 8 (2)]

-

1. In this Schedule, reference to a "tariff item", "heading", "sub-heading" and "Chapter", wherever they occur, shall mean respectively a tariff item, heading, sub-heading and Chapter in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975).

2. The rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), the section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this Schedule.

-